what is a reit

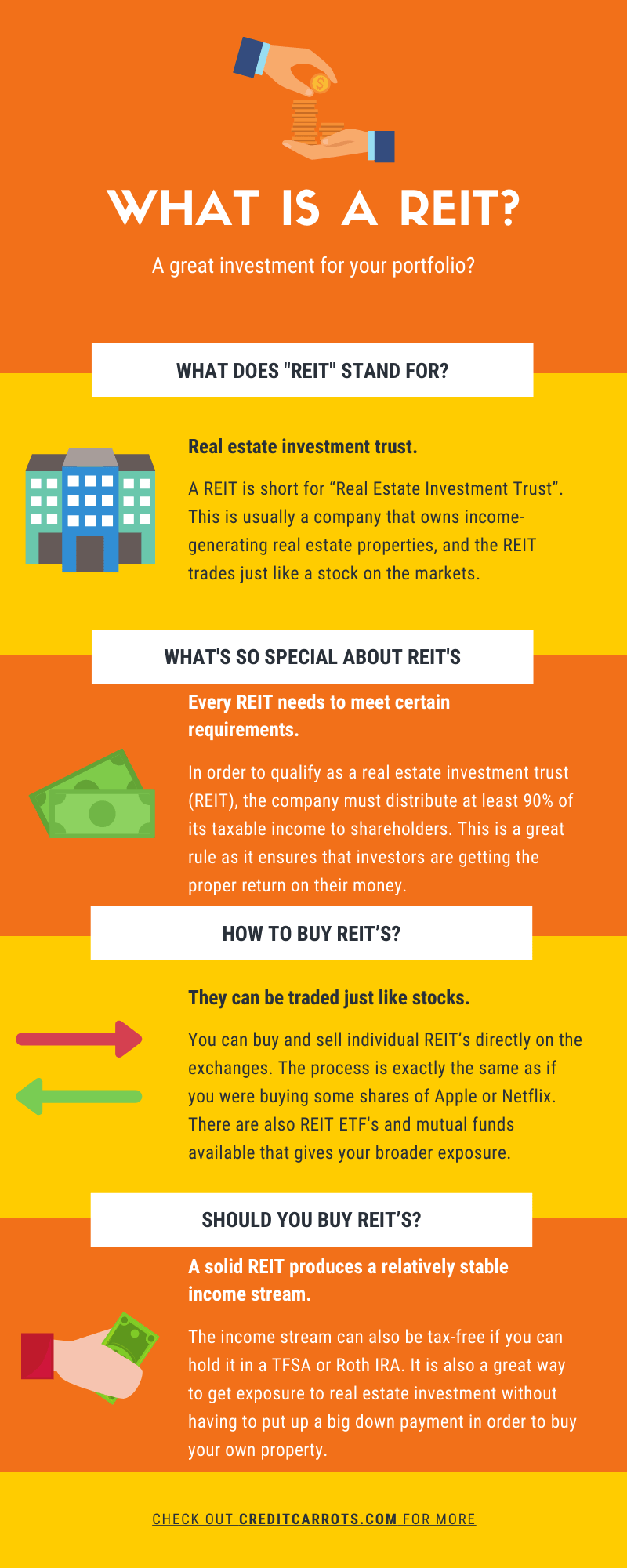

A REIT is a real estate investment trust that owns operates or finances properties that produce income in a particular sector of the real estate market. A REIT real estate investment trust is a company that makes investments in income-producing real estate.

|

| What Is A Reit |

A real estate investment trust REIT is a company that owns and in most cases operates income-producing real estate.

. REITs were created by Congress in. A Real Estate Investment Trust REIT is a company that owns and operates income properties collecting rent from residential or commercial tenants. A REIT or a Real Estate Investment Trust is a type of company that is designed to own operate or finance real estate. REITs or real estate investment trusts are companies that own or finance income-producing real estate across a range of property sectors.

With negative real bond yields here is how you can invest for passive income right now. What Is a Real Estate Investment Trust REIT. There are a variety of commercial and residential properties. C-REIT from CrowdStreet reinvents the REIT for private real estate investors.

Investors who want to access real estate can in turn buy shares. REITs allow the average investor to participate in the real estate market through passive investments through the purchase of company stock or exchange traded funds and. What Is a REIT. REITs own many types of commercial real estate including.

In South Africa a REIT. REITs are an easy way for investors to get started in real. Real estate investment trusts REITs allow individuals to invest in large-scale income-producing real estate. Learn How Farmland Could Help You Lower Risk Exposure And Stabilize Your Portfolio.

Investors can buy publicly. A REIT is a company that owns and typically operates income-producing real. A real estate investment trust REIT is a company that owns finances or manages properties that generate income. A REIT is a way to increase the amount of real estate in your financial portfolio without requiring you to actually buy a piece of property.

Ad Farmland Has Outperformed Most Major Assets And Alternatives. These real estate companies have to. A real estate investment trustthe cool kids call it a REIT pronounced reetis basically a mutual fund that buys real estate. A REIT or real estate investment trust owns operates or finances properties that produce income in a particular sector of the real estate market.

REITs are firms whose sole purpose is to own and operate real estate properties. Ad Direct access to a range of real estate investments including funds and our new REIT. Ad Help Clients Target Better Outcomes With Alternatives. A group of investors will pool their money together to invest in a REIT which makes it.

What is a real estate investment trust REIT. Instead of using abated rent tenant. Investors can buy shares. Basically can a reit make a deal with a tenant that it will give them an agreed upon amount of shares if they sign lease and pay on time for the term.

Some invest in commercial property such as parking lots or office buildings. A real estate investment trust REIT is a company that owns and operates income-generating real estate. A REIT or a real estate investment trust is an organization that owns and operates income-generating real estate. Ad Each of these 3 companies pays around 10 to its shareholders annually.

Ad REITs Allow You To Invest In Real Estate Without Buying Property. Taking a page from. A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income-producing real estate assets. A Real Estate Investment Trust REIT is a company that owns and operates income properties collecting rent from residential or commercial tenants.

|

| Reit Investing An Exceptional Passive Income Stream |

|

| What Is A Reit Credit Carrots |

|

| Emergence Of Real Estate Investment Trusts In Sri Lanka |

|

| What Is A Reit And When Was It Created Rei Capital Growth Are Reits A Good Investment Now |

|

| What Is A Real Estate Investment Trust |

Posting Komentar untuk "what is a reit"